Understanding your rights as an employee is crucial, especially when it comes to your wages. In the UK, there are laws in place to protect workers from unlawful deduction of wages, non-payment of wages, and illegal payroll deductions. However, many employees are not aware of these rights and often find themselves victims of wage underpayment. This comprehensive guide aims to shed light on the topic of claiming unlawful deduction of wages, providing expert advice on how to navigate this complex issue.

Understanding Unlawful Deduction of Wages

Unlawful deduction of wages occurs when an employer makes deductions from an employee’s salary without their consent or without a valid reason. This can include deductions for mistakes made by the employee, advance deduction on payslips, or any other deductions that are not lawful. It’s important to note that it is illegal not to get a payslip in the UK, as this document is crucial in identifying any potential payroll discrepancies.

What Constitutes Unlawful Deductions?

Unlawful wage deductions can take many forms. Here are some examples:

- Deductions from salary without consent

- Unlawful payroll deductions

- Non-payment of wages

- Less lawful deductions meaning deductions that are not permitted by law

- Deductions for mistakes made by the employee

It’s important to note that not all deductions are unlawful. For instance, deductions for tax and National Insurance contributions are lawful and required by law.

Claiming Unlawful Deduction of Wages

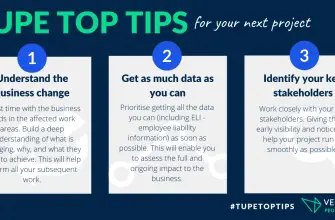

If you believe you have been a victim of unlawful deduction of wages, you have the right to make a claim. The process involves several steps:

- Identifying the unlawful deduction: This involves reviewing your payslips and identifying any deductions that you did not consent to or that are not lawful.

- Speaking to your employer: Before making a formal claim, it’s advisable to speak to your employer about the issue. They may be able to rectify the situation without the need for legal action.

- Making a formal claim: If your employer does not rectify the situation, you can make a formal claim to an employment tribunal. This should be done within three months of the unlawful deduction.

Unlawful Deduction of Wages Time Limit

When it comes to claiming unlawful deduction of wages, time is of the essence. In the UK, you have three months less one day from the date of the last unlawful deduction to make a claim. However, in some cases, you may be able to claim for a series of deductions, even if the first one occurred more than three months ago. This is known as a ‘series of deductions’.

How Far Back Can You Claim Underpayment of Wages?

As per the Deduction of Earnings Order, you can claim for underpayment of wages going back up to two years before the date you make your claim. This means that if you have been underpaid for a long period of time, you may be able to recover a significant amount of money.

Can an Employer Deduct Wages for Mistakes?

While it may seem unfair, an employer can legally deduct wages for mistakes made by an employee. However, there are strict rules around this. The deduction must be specified in the employee’s contract, and the employer must have discussed the issue with the employee before making the deduction. If these conditions are not met, the deduction may be unlawful.

Conclusion

Understanding your rights when it comes to your wages is crucial. If you believe you have been a victim of unlawful deduction of wages, it’s important to take action as soon as possible. Speak to your employer, review your payslips, and if necessary, make a formal claim to an employment tribunal. Remember, you have the right to fair pay for your work.