Businesses not only have a fixed duty to comply with rules concerning the Directors’ remuneration of the Company. But they also have to respond to the cultural demand from investors to be seen to be acting openly and fairly, as evidenced by the recent trend towards accountability and transparency in respect of corporate governance and the increase in shareholder activism. Compensation for business directors is a topic of discussion in this article. It is subject to different forms of oversight, especially for publicly dealt businesses.

How much do board members get paid?

Directors’ remuneration refers to the procedure by which shareholders, the board of directors, and, in some cases, designated committees of the business determine the fees, salaries, and other benefits to be paid to, or otherwise provided to, the company’s directors. How a company’s board of directors gets paid depends on several factors, including the company’s scale and whether or not it is publicly traded.

All-New Rules and Difficulties in Directors’ Remuneration

The UK-quoted companies were on the cusp of having to comply with the Directors’ Remuneration Report Regulations 2002. It was done when the first version of this Guide was released. These rules mandated increased transparency from publicly traded businesses. It granted investors a say in executive compensation through a non-binding vote. We just had to stay for a stunt over six months for the first negative response. Directors’ remuneration, and especially rewards for failure,’ have been under intense scrutiny from the media and lawmakers ever since. The European Union Commission has just adopted a suggestion on “fostering an appropriate regime for the remuneration of directors of listed companies,” coinciding with this version of the Guide. The good news for those businesses is that the proposed changes are so similar to the UK rules that the UK won’t have to change a thing to comply.

The remuneration committee and the non-administrative leaders who perform on it have been under boosting scrutiny. The compensation group has to explain adequately to all shareholders, not just the thoughtful ones. It has a thankless job to do. The media will focus solely on its failures, not its triumphs. If the executive director departs and is seen to have been rewarded, the board will take the heat, even if the departure has nothing to do with performance. As with so many other aspects of business life, the challenge for remuneration committees is assessing the quality of the advice they receive. This introductory Guide does not pretend to offer easy solutions to complex issues. However, the summary aids the remuneration committee’s non-executive directors in formulating pertinent queries and thoroughly analyzing the answers they receive.

The UK’s Rules for Business Conduct

Companies with a premium listing on a UK-regulated market for fiscal years beginning on or after January 1, 2019. It must comply with this set of standards issued by the Financial Reporting Council. Any business trading on a UK stock exchange included in the FCA’s register is subject to the LR. Under the LR, businesses can file for either a standard or premium listing, with the difference being the stringency of the requirements they must meet.

The Code aims to promote the long-term sustainable success of individual businesses. It aligns with its purpose and values by establishing best practices for company remuneration policies and procedures.

- To maintain a premium listing, a business must adhere to the listing requirements established by EU law. It also adheres to additional UK provisions outlined in the Listing Rules (LR).

- Compliance with EU law is all that is needed for a standard entry.

The Code has been revised twice: in 2016 and again in 2018. For last year beginning on or behind 17 June 16, and before 1 Jan 19, utilise the 2016 model. For the years starting on or after 1 Jan 19, use the 2018 edition.

Payment Disclosure – Two-Strike Policy in Directors’ Remuneration

The “two strikes” regulation concerning the remuneration report became effective as of July 1 2011, thanks to amendments to the Corporations Act 2001. The shareholders’ vote on the compensation report is essential to the yearly general meeting. When more than a quarter of shareholders decide against a company’s compensation report, that counts as a “no,” the first strike. In such cases, the business must explain its subsequent remuneration report as to whether or not shareholders’ concerns have been addressed and, if so, how.

If the company’s following salary report also gets a “no” vote of 25% or more, it will be considered a “second strike.” In such cases, shareholders will decide by the board members. It must run for reelection within 90 days at the same annual public meeting. If most voters approve this motion, the unique “spill meeting” will be held within 90 days. When the report was discussed at the most recent annual general meeting, directors in office will have to run for reelection at the runoff meeting.

Compensation rights In Directors’ Remuneration

It’s essential to differentiate between the following when thinking about a director’s compensation:

- a director who is employed by the business under a service agreement that provides for the director to be paid a salary and other remuneration

- a member of the board who is not an employee of the firm

Directors have no right to payment or reimbursement of costs simply. It is because they hold the director position under the CA 2006 or otherwise. However, it is common for articles of association to state that directors are entitled to such compensation as they may determine:

- for any other service which they perform for the company

- for their services to the company as directors.

The business needs the authority to compensate its directors if the articles specifically authorize payment of such compensation.

As stated in the company’s articles, directors are typically entitled to reimbursement for reasonable costs spent attending meetings.

A director may be eligible for compensation from the business under the terms of a service agreement. It may be due to the company’s articles of association. The specifics of their employment agreement will determine the director’s payment. See Practice Note: Directors’ compensation for more details.

Compensation details made public.

The company’s registered office must keep a copy of each director’s service contract for public inspection.

In the notes to their financial statements, all companies must reveal specific details about their directors’ compensation. Whether a business is small, medium, unquoted, or quoted determines the necessary degree of disclosure.

How should compensation for board members be set up?

Director compensation structures vary greatly. The method used by an organization must be modified to fit its unique needs. The ASXCorporate Governance Principles, however, do provide some broad recommendations. Companies should set apart the compensation structure of their non-executive directors from that of their executive directors and top executives.

According to the Corporate Governance Principles, businesses should consider several factors when deciding how much to pay their non-executive members.

- Fees in currency, non-paid concessions, superannuation assistance, or earnings renunciation into equity are standard conditions of income for non-administrative leaders. Non-organizational managers should not typically involve in projects intended for the income of administrators.

- Bonuses and stock options should not be given to non-executive board members.

- In addition to their superannuation, non-executive directors should not receive any other retirement perks.

The Corporate Governance Principles recommend that executives receive a mix of set and incentive compensation. The following topics are covered in greater depth by those Principles:

- Equity-based compensation,

- Performance-based compensation

- Termination payments, and

- Set payments

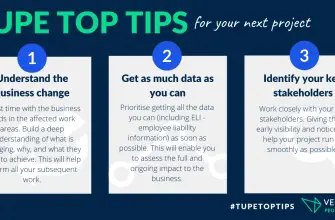

Smaller companies may need help to afford the services of remuneration experts to help them determine the appropriate size and structure of director compensation. Information about the use of compensation consultants must be made public by publicly traded businesses. Similarly, remuneration advisors must be employed by non-administrative managers and submitted to either the commission or non-organizational directors.

Who sets the salaries of the committee of directors?

The business itself (typically following conditions in the managers’ service agreements) is responsible for determining and paying the compensation of its directors. Shareholders, employees, the company’s remuneration committee, and the publication of best practices by prominent industry bodies all play increasingly essential roles in the decision-making process, especially for listed companies.

It is recommended that companies establish a remuneration group, which operates independently from the board of directors, to oversee the company’s compensation practices.

The revenue commission’s responsibility is to provide that the payment policy for the company’s executive directors, senior leadership, and council chair is consistent. It is committed to the company’s mission, using the authority granted to it by the board of directors.

Compensation Policies for Directors’ Remuneration

The Remuneration Committee of the Institut Luxembourgeois des Administrateurs has proposed the following principles to be used as a basis for defining compensation for executive officers, taking into account the recommendations of the Commission of the European Communities. After consulting with its shareholders and significant representatives of the Luxembourg business community, the deadline repeated cast of the “Ten Principles of Corporate Governance of the Luxembourg Stock Exchange.” These recommendations apply to both publicly traded and privately held businesses.

- Following the company’s long-term objectives, the board of directors (supervisory board) must establish and execute a comprehensive compensation policy. All employees and directors, not just the executive or board level, should be covered by this compensation strategy.

- Non-executive directors’ pay must be kept separate from the executive’s (management). It’s distinct in several ways, including risk-taking, connection to business performance, and distribution of profits.

- The compensation committee should comprise independent directors and not include any senior staff members. At least three individuals should serve on the compensation committee.

- To establish a compensation plan that is competitive with the market, the committee’s members must have access to the technical data and market information necessary to do so. At least one member must have demonstrated expertise in the field of executive remuneration, ideally gained in a senior human resources responsibility.

- The business should adopt a compensation policy and supervisory structures offering executives and directors competitive compensation. And that is fair and sustainable over the long term.

- The supervisory board (board of directors) should appoint a compensation group to create a compensation package for the company’s top executives and present it for board approval. The compensation group should also create director compensation packages

Some Other Policies:

- The remuneration committee may seek assistance from external remuneration experts due to the growing complexity of incentive and remuneration arrangements. Suppose the assistant is a member of a company with other money-giving connections with the commodity to which remuneration recommendation is given. In that case, care must be taken to avoid any appearance of a conflict of interest or undermine any claims of independence.

- It is suggested that an appropriate balance be established between set and variable remuneration, including but not limited to share options, director’s fees, retirement and departure conditions, and specific benefits.

- There should be a connection between the variable parts of compensation and measurable success criteria, both financial and otherwise. The criteria for evaluating the board or executive management should be consistent with the company’s intermediate and long-term goals. They should factor in the success and potential of the company’s growth, the value it has created for the company and its shareholders, and the results of each member. The board-determined acceptable amount of risk should also be factored into the criteria.

- As part of its financial reporting, the business must disclose its remuneration policy for executive and non-executive directors. It includes the metrics used to determine pay increases or decreases based on performance. (annual report).

- The company’s compensation plan should be evaluated at least once a year.

- Executive and director compensation is primarily for the business and its shareholders to determine.

The method used to determine directors’ compensation varies from company to business and is likely to be determined by the specifics of the current fiscal year. Each policy within the remuneration policy should be designed to foster the ongoing success of the business. It should reflect the strategy and values of the company as a whole.