The recent changes to the IR35 rules have caused a significant stir in the private sector. The new off-payroll tax rules, which came into effect in April 2021, have brought about a significant shift in how businesses manage their contractors and freelancers. The IR35 legislation, initially introduced in 2000, was designed to combat tax avoidance by workers supplying their services to clients via an intermediary, such as a limited company, but who would be an employee if the intermediary was not used. However, the recent changes have expanded the scope of the legislation, causing many businesses to reassess their relationships with contractors and freelancers. This article aims to provide a comprehensive guide to navigating the new IR35 private sector rules.

Understanding the Changes to IR35 Rules

The changes to the IR35 rules primarily affect medium and large businesses in the private sector. Previously, contractors were responsible for determining their own IR35 status. However, under the new rules, the responsibility for making the IR35 determination has shifted to the end client. This means that businesses are now responsible for assessing whether their contractors fall inside or outside the IR35 rules.

Contractors deemed to be inside IR35 are considered for tax purposes to be employees. This means that the business is responsible for deducting income tax and National Insurance contributions before paying the contractor. On the other hand, contractors deemed to be outside IR35 can continue to be paid gross and are responsible for their own tax and National Insurance contributions.

Implications of the IR35 Changes

The IR35 changes have several implications for businesses and contractors alike. For businesses, the main impact is the increased administrative burden. Businesses are now required to make an IR35 determination for each of their contractors and provide a Status Determination Statement (SDS). The SDS must provide a detailed explanation of the decision and the reasoning behind it. If a contractor disagrees with the determination, businesses are required to have a dispute resolution process in place.

For contractors, the changes could potentially result in a significant reduction in take-home pay if they are deemed to be inside IR35. This is because they will be taxed at source, like an employee, but without receiving the benefits that come with employment, such as holiday pay and sick pay.

Navigating the New IR35 Legislation

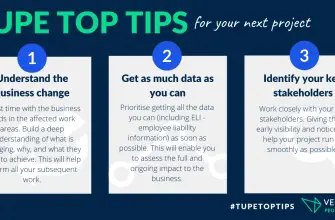

Given the potential implications of the IR35 changes, it is crucial for businesses and contractors to understand how to navigate the new rules. Here are some key steps to consider:

- Understand the rules: The first step is to fully understand the new IR35 legislation. This includes understanding the criteria used to determine whether a contractor falls inside or outside IR35. The key factors considered include control, substitution, and mutuality of obligation.

- Review contracts: Businesses should review their contracts with contractors to ensure they reflect the actual working practices. If a contract looks like an employment contract, it could potentially fall inside IR35.

- Conduct an IR35 assessment: Businesses should conduct an IR35 assessment for each of their contractors. This involves assessing the working practices against the IR35 criteria. It is advisable to document the assessment process and the reasons for the determination.

- Communicate with contractors: It is important for businesses to communicate with their contractors about the IR35 changes and the potential implications. This includes providing the SDS to the contractor and the agency, if one is involved.

- Prepare for disputes: Businesses should have a dispute resolution process in place in case a contractor disagrees with the IR35 determination. This involves reviewing the determination and considering any evidence provided by the contractor.

Conclusion

The changes to the IR35 rules represent a significant shift in the tax landscape for businesses and contractors in the private sector. While the changes may seem daunting, with a clear understanding of the new rules and a proactive approach to compliance, businesses can successfully navigate the new IR35 legislation. It is advisable for businesses to seek professional advice to ensure they are fully compliant with the new rules and to avoid potential penalties.