The advent of technology has made it possible for employees to work from virtually anywhere in the world. This has led to a rise in the number of people working remotely from overseas. However, for UK employers, managing overseas remote work can be a complex task, especially when it comes to navigating the legalities. Understanding how long you can work remotely in another country, whether it is legal to work remotely from another country, and the implications of working remotely for another country are all crucial aspects that need to be considered. This article aims to provide a comprehensive guide for UK employers on the legalities of overseas remote work.

Understanding the Legalities of Overseas Remote Work

Before delving into the specifics, it’s important to understand that the legalities of overseas remote work can vary greatly depending on the country in question. Some countries have specific laws and regulations in place for remote workers, while others may not. Therefore, it’s crucial for UK employers to research and understand the legal landscape of the country where their remote employees will be working.

Employment Laws

One of the key legal considerations for UK employers is the employment laws of the country where the remote worker is based. These laws can cover a wide range of issues, including working hours, minimum wage, holiday entitlement, and more. For instance, if a UK employer has an employee working remotely from another country, they may be required to comply with that country’s employment laws, which could be more stringent than those in the UK.

Taxation

Another important legal consideration is taxation. The question of where and how a remote worker should be taxed can be a complex one. In general, an employee working remotely in another country may be liable to pay tax in that country. However, this can depend on various factors, such as how long the employee is working in that country, their residency status, and more. UK employers need to be aware of these issues and ensure they are complying with all relevant tax laws.

Immigration Laws

Immigration laws are another crucial aspect to consider. Even if an employee is working remotely, they may still need to comply with the immigration laws of the country they are in. This could include obtaining a work visa or permit. UK employers should ensure they are aware of these requirements and assist their employees in meeting them.

How Long Can You Work Remotely in Another Country?

The length of time an employee can work remotely in another country can depend on a variety of factors, including the immigration laws of that country, the type of work being done, and the specific arrangements between the employer and employee. Some countries may allow remote work for a certain period without requiring a work visa, while others may require a visa from day one. It’s important for UK employers to research this thoroughly and ensure they are in compliance with all relevant laws.

Is It Legal to Work Remotely from Another Country?

Generally speaking, it is legal to work remotely from another country, provided that all relevant laws and regulations are adhered to. This includes employment laws, tax laws, and immigration laws. However, the specifics can vary greatly from one country to another, so it’s crucial for UK employers to do their homework and ensure they are fully compliant.

Working Remotely for Another Country

When an employee is working remotely for a UK employer from another country, there are a few additional considerations to keep in mind. For instance, the employee may be subject to the laws of both the UK and the country they are working in. This could have implications for things like data protection and privacy laws, which can vary greatly from one country to another. UK employers should ensure they are aware of these issues and take steps to ensure compliance.

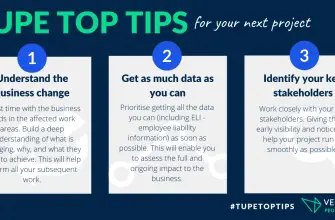

Key Takeaways for UK Employers

Managing overseas remote work can be a complex task, but with careful planning and consideration, UK employers can navigate the legalities effectively. Here are some key takeaways:

- Research the legal landscape of the country where the remote worker will be based, including employment laws, tax laws, and immigration laws.

- Understand how long an employee can work remotely in another country and ensure compliance with all relevant laws.

- Ensure that remote work is legal in the country in question and that all necessary permissions and permits are obtained.

- Be aware of the implications of having an employee working remotely for a UK employer from another country, including potential issues around data protection and privacy.

In conclusion, while overseas remote work can present some legal challenges for UK employers, these can be managed effectively with the right knowledge and preparation. By understanding the legalities involved and taking steps to ensure compliance, UK employers can reap the benefits of a global workforce while minimizing potential legal risks.