The payment of employees for their time off and holidays is necessary to provide them with rest and recharge, resulting in increased productivity. Rolled-up holiday pay is a practice some employers use to provide holiday pay to their employees. Employers do not provide time off with pay; instead, they include the employee’s right to paid leave in their regular compensation.

If you’re an employer looking for ways to provide employee holiday pay, rolled-up holiday pay can be an option. There are advantages and disadvantages to holiday pay and specific legal issues to consider.

This article will help employers understand what holiday pay is, how it works, and its legal considerations. Employers will learn about the benefits and risks of rolled-up holiday pay and how it can impact their business and employees.

How Does Rolled-Up Holiday Pay Work?

Rolled-up holiday pay is when employers incorporate employee holiday benefits into their regular salaries or wages. Instead of giving their employees paid time off, employers calculate the value of their holiday benefits and pay them out monthly or weekly. In this manner, workers get their holiday pay and regular paychecks.

The amount of holiday pay included in the employee’s wages will depend on factors such as how many hours they have worked and how much holiday time they have earned.

For instance, if an employer has a full-time employee entitled to 28 days of annual leave, they may include a percentage of the employee’s gross pay as holiday pay. This means that for every hour worked, the employee would receive an additional payment equivalent to what they would have received if they had taken the day off. The employer sets this percentage.

Holiday pay can simplify payroll for employers, as they do not have to administer holiday pay separately. Improper implementation of this practice could pose risks. In the upcoming parts, we will look into the risks associated with holiday pay and offer guidance on managing it effectively.

Check our Guide about: Occupational Sick Pay

Rolled-Up Holiday Pay: Is it Legal?

There is a disagreement about the legality of rolled-up holiday pay. According to some sources, this practice may be legal for workers with irregular work schedules, such as casual workers or those who work zero hours. However, the law restricts rolled-up holiday pay. It requires that it be paid separately when annual leave is taken or throughout the year.

Employees are generally discouraged from receiving rolled-up holiday pay by the government, as it can be challenging to calculate and may result in them receiving less than their entitlement.

Rolled-up holiday pay can be a complicated legal matter. It might depend on the employee’s and employer’s specific circumstances. Both parties should be aware of their rights and obligations regarding holiday pay, and if necessary, they should seek legal counsel.

If employers are going for rolled-up pay, they must also ensure it is in the employee’s contract. If regular holiday pay is an entitlement and an employee’s contract does not mention rolled-up holiday pay, then it is necessary to pay the holiday pay separately. In that case, it may need to be clarified whether changing his holiday pay status is legal.

In summary, we generally consider rolled-up holiday pay to be illegal in the United Kingdom. However, you can work your way around by making policies that are in compliance with legal requirements.

How to Calculate Rolled-Up Holiday Pay?

If both the employer and the employee agree on rolled-up holiday pay, they can take the following steps to calculate it:

- Determine the employee’s eligibility. A UK employer normally calculates rolled-up holiday pay as a percentage of the worker’s hours or days of employment. A full-time employee working five days a week receives 5.6 weeks of paid holiday per year, which is equivalent to 28 days. For part-time employees, the employers may calculate holiday entitlement equally.

- Calculate rolled-up holiday pay. The employer can calculate the pay by multiplying the employee’s entitlement by the hourly or daily pay rate. For example, if an employee is entitled to 28 days of holiday and their daily pay rate is £100, the rolled-up holiday pay would be £2,

- Deduct any holiday pay already taken. If the employee has already taken some holiday during the year, the employer should deduct this from the rolled-up holiday pay. For example, if an employee takes 10 days of vacation out of 28 days, the employer should only pay for the remaining 18 days.

- Adjust for tax.There are different methods for calculating tax and national insurance contributions for rolled up holiday pay, depending on the specific circumstances of the employee and the employer.

- Record the payment. The employer must record the payment of rolled-up holiday pay in the employee’s payroll records. The employer should identify the payment as holiday pay and deduct it from the employee’s regular pay.

What Are the Risks of Rolled-Up Holiday Pay?

Rolling over holiday pay is a convenient option for employers, but it comes with several risks.

- One significant risk is failure to comply with the law, as the Working Time Regulations in the UK require that workers receive a minimum of 5.6 weeks of paid leave annually. Replacing this right with rolled-up holiday pay may be illegal and lead to penalties.

- Another risk is that employees may be unable to take time off work, feeling forced to work without taking a break if paid in advance for their holiday benefits. This can lead to decreased productivity, harming the employer in the long run.

- Moreover, rolled-up holiday pay can make monitoring how much holiday benefits an employee has earned challenging. Suppose an employee plans to leave the company. In that case, the employer may struggle to calculate how much holiday pay they owe, leading to conflicts and legal issues.

Before implementing rolled-up holiday pay, employers should carefully evaluate the risks involved. Employers must comply with the law and communicate the practice to employees if they use it.

How to Avoid Legal Problems When Using Rolled-Up Holiday Pay?

To prevent legal issues associated with rolled-up holiday pay, employers need to follow these guidelines:

- Pay holiday pay when the employee takes their holiday. Rolled-up holiday pay is not legal, and employers must ensure that workers receive their full holiday pay entitlement when they take their holiday. When taking a holiday, employees must receive this payment separately from their regular pay.

- Use the correct calculation method. The employer should calculate the employee’s pay for their annual leave based on a week’s working hours averaged over 52 weeks. Those with fixed working hours deserve 5.6 weeks of paid annual leave per year.

- Do not cap holiday pay. Employers should not limit holiday pay to a percentage of hours worked. The employer must provide part-time employees with 5.6 weeks of paid leave per year. Their holiday pay must be based on the statutory week’s pay formula, which typically only reflects worked weeks.

- Include commission payments in holiday pay. The law requires employers to include commission payments in holiday pay for the first four weeks of holiday under the working time regulations.

- Consult legal advice. Employers who are still determining how to calculate holiday pay for their workers should seek legal advice. It is essential to ensure that all employees receive their full holiday pay entitlement and that the employer complies with the law.

Can Employers Deduct Payment for Unused Holiday Benefits?

It is a common question among employers if they can deduct money from an employee’s pay for unused holiday benefits, particularly in the context of rolled-up holiday pay. The short answer is no unless both the employer and the employee have a written agreement that allows them to do so.

In the United Kingdom, the Working Time Regulations 1998 guarantee employees a minimum of 5.6 weeks of paid leave per year, with any unused leave carried over to the following year.

However, there are some exceptions. Employers can deduct money from an employee’s pay for unused leave if they have a written agreement allowing them to sell back their vacation time for cash. However, such agreements are rare and must comply with the Working Time Regulations.

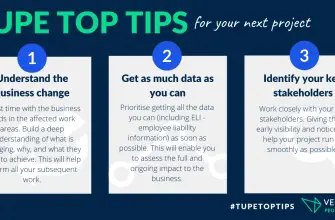

How to Handle Disputes About Rolled-Up Holiday Pay?

Disagreements about holiday pay can arise when there is a misunderstanding or disagreement about the practice or the amount of advance holiday pay.

Here are some recommendations for resolving disputes:

- Examine the Employment Contract. Employers should check if the employment contract specifically mentions and accepts holiday pay. In cases where there is confusion or disagreement about holiday pay, employers need to clarify the contract terms.

- Provide Transparent Communication. Employers must explain the details of rolled-up holiday pay simply and clearly, including the total amount of paid holiday entitlement and how it will be de Employers should also offer employees written documents explaining their holiday entitlement and its calculation.

- Maintain Accurate Records. Employers should maintain detailed records of their employees’ holiday entitlement, including the amount paid in advance and used. This will help prevent disputes and provide a clear record of how much holiday entitlement the employee has received.

- Seek Legal Advice. Employers may need to seek legal advice if they cannot resolve a dispute through any means. Employment law can be complex, and it is important for employers to ensure that they follow it and protect the rights of their employees.

Employers who follow these recommendations can resolve holiday pay disputes fairly and efficiently. Employers should prioritise clear communication and accurate record-keeping to avoid disputes.

Can employers deduct money for unused holiday entitlement?

Employers sometimes deduct money for unused holiday entitlement if it is clearly stated in the employment contract or the employee has agreed to it. Employers must, however, ensure compliance with local laws and regulations, including those governing minimum wage and holiday entitlement.

Many employees need clarification about their rights when it comes to holiday pay. The good news is that employees cannot have money deducted from their pay as a penalty for unused leave, according to the law.

It’s important to know your rights and understand the specifics of your employment contract, as different rules may apply depending on the industry and the terms of your agreement. if you have concerns about how your workplace handles holiday pay it is important to speak up and address any issues with your employer.

Conclusion

Holiday pay can benefit both employers and employees. Still, it should be used appropriately and in compliance with local laws and regulations

Using holiday pay carries risks such as legal issues, employee confusion or disputes, and insufficient rest and time off. Employers can prevent legal problems by complying with the law, communicating clearly with the employees, keeping accurate records, and exploring other practices. Employers should prioritise clear communication and precise record-keeping to prevent disputes.

Administrators who understand the risks and follow best practices can ensure that holiday pay benefits their business and employees.

Frequently Asked Questions (FAQs)

Rolled-up Holiday pay is a payment made by an employer before an employee’s holiday entitlement. Instead of taking paid time off, the employee is paid their normal wages for the time they would have taken as a holiday. This is a common practice in some countries, but it must be used in compliance with local laws and regulations.

The amount of rolled-up holiday pay is calculated using the employee’s hourly or daily rate of pay and the number of hours or days of holiday entitlement paid in advance. For example, if an employee earns £10 per hour, works 10 hours a day, and is paid in advance for 5 days of holiday entitlement, their rolled-up holiday pay would be £500.

Employers can avoid legal problems with rolled-up holiday pay by following the law, communicating the practice clearly to their employees, maintaining accurate records, and considering alternative practices. To ensure compliance with local laws and regulations, employers should review their employment contracts and seek legal advice if necessary.