Understanding the UK work uniform laws is crucial for both employers and employees. These laws govern everything from the provision and maintenance of uniforms to the tax implications of uniform allowances. This comprehensive guide will delve into the intricacies of these laws, providing valuable insights into the rights and responsibilities of both parties. We will explore topics such as the civil service dress code, the works uniform, compulsory and non-compulsory work uniforms, and the implications of uniforms as personal protective equipment (PPE). We will also discuss the legalities around changing into uniforms at work, the implications of not returning uniforms, and the potential for discrimination based on clothing.

Understanding the Basics of UK Work Uniform Laws

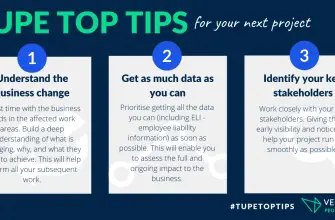

Work uniform laws in the UK are designed to protect the rights of workers and ensure fair treatment. These laws cover a wide range of issues, including the provision of uniforms, the responsibility for cleaning and maintaining uniforms, and the right to a uniform tax allowance. They also cover more complex issues such as the legality of compulsory work uniforms and the rights of employees who are forced to wear a skirt or other gender-specific clothing.

Compulsory vs Non-Compulsory Work Uniforms

One of the key distinctions in UK work uniform laws is between compulsory and non-compulsory work uniforms. A compulsory work uniform is one that an employee is required to wear as part of their job. This could include uniforms for jobs that require uniforms such as police officers, nurses, or cleaners uniforms in the UK. On the other hand, a non-compulsory work uniform is one that an employee can choose to wear but is not required to. This could include a company-branded polo shirt or a specific colour of clothing.

Uniform Tax Allowance and Washing Uniform Allowance

Employees who are required to wear a uniform for work may be eligible for a uniform tax allowance. This is a tax relief that can be claimed to cover the costs of buying, cleaning, and maintaining a work uniform. The washing uniform allowance is a specific part of this tax relief that covers the cost of cleaning a work uniform.

Changing into Uniforms at Work

Another important aspect of UK work uniform laws is the issue of changing into uniforms at work. In some cases, employers may require employees to change into their uniforms off the clock. However, this practice can be controversial and may be subject to legal challenges. Employers should be aware of the potential legal implications of this practice and should consider paying employees to change into uniforms to avoid potential disputes.

Employee Uniform Agreement

An employee uniform agreement is a document that outlines the responsibilities of both the employer and the employee in relation to the provision and maintenance of a work uniform. This agreement should clearly state who is responsible for providing the uniform, who is responsible for cleaning and maintaining the uniform, and what happens if the uniform is not returned at the end of employment.

Uniforms as Personal Protective Equipment (PPE)

In some industries, uniforms are considered to be personal protective equipment (PPE). This means that they are designed to protect the wearer from specific hazards in the workplace. In these cases, the employer is typically responsible for providing the uniform and ensuring that it is properly maintained.

Discrimination Based on Clothing

UK work uniform laws also cover the issue of discrimination based on clothing. This means that employers cannot discriminate against employees based on their choice of clothing, unless there is a legitimate business reason for doing so. For example, an employer cannot force an employee to wear women’s clothes to work unless there is a valid reason for this requirement.

Uniform Allowance Tax Code

The uniform allowance tax code is a specific code that is used to claim tax relief for the costs of buying, cleaning, and maintaining a work uniform. This code can be used by employees who are required to wear a uniform for work and who incur these costs themselves.

Conclusion

Understanding UK work uniform laws is crucial for both employers and employees. These laws cover a wide range of issues, from the provision and maintenance of uniforms to the rights and responsibilities of both parties. By understanding these laws, employers can ensure that they are treating their employees fairly and legally, while employees can ensure that they are receiving the rights and benefits to which they are entitled.