If you are an employee in the UK and need to learn more about the calculation of holiday pay and stuff, or you are an employer facing difficulties with holiday pay and entitlement for your workers. Don’t worry; we have covered it all for your convenience.

The laws in the UK provide workers with a statutory entitlement to paid leave. This guide will help you calculate the paid leave(s) for employees with contracts, casual workers, agreements, part-time workers, and employees with fixed and irregular work hours.

As we all know, the government of the UK has strict laws regarding the rights of their workers, especially migrant workers. Out of these laws, the primary right of the worker is to get a minimum amount of paid time off work as a holiday or in the form of annual leave.

The calculation of an employee’s holiday pay and entitlement is based on the number of hours that the employee has worked for their employer. Therefore, the employer needs clarification when the employee does not work fixed and regular hours for the organisation. The whole scenario changes after all these complications. However, it is common to feel confused after calculating the paid time, particularly for those who struggle with mathematics..

The following guide for employers and workers will help solve all your queries and concerns regarding holiday pay.

Calculating the Rate of Holiday Pay:

First, all the employees are eligible for one week of pay for every week of statutory leave that they get in one week.

Well, it means there are two holidays in one week; therefore, in the case of calculating the holiday pay, the worker will get the pay for these two holidays of that week. Now it looks understandable. Isn’t it? If you do not understand this, tell us in the comments below any of your concerns.

Check our Guide about: Occupational Sick Pay

Rules for calculating the rate of holiday pay

Before we go down and explain the calculations of the rate of holiday pay, it is better to understand the rules for calculating the rate of holiday pay. So without wasting any time, let’s find out these rules:

- Fixed Pay or Hours; whether the employee is full-time or part-time, the person will get holiday pay for a week.

- Shift With Fixed Hours; This type of worker with full or part-time employment is an entitlement to holiday pay with the average of fixed weekly hours in the previous 52 weeks; he/she has worked in the organisation.

- No Fixed Hours; This includes working patterns, such as casual work, including zero-hours contracts. This employee is an entitlement to the paid time off because of average pay from the previous 52 weeks. Remember, this only includes those weeks they paid the person.

So these were the rules before the calculations of the rate of holiday pay. Please understand these, if not, then tell us in the comments for your answers.

The working pattern of Employee

The workers work in different working patterns. Some work in non-fixed and non-regular hours after mutual agreement between the employer and the employee. However, some work part-time with fixed days or fixed hours.

However, other workers have the working pattern of shift, casual, term-time, and zero-hours contracts with variable pay or hours. Below, we have explained all these patterns, so you can understand all with ease.

No fixed hours

In other scenarios, if an employee did not work fixed hours or regular hours and did not receive the same amount of pay for each week and month, the employer can then calculate the holiday pay by looking at the working hours of the employee for the previous 52 weeks (1 year) from the organisation’s Payroll.

The term used commonly for this is the “holiday pay reference period”. Interestingly, this period used to be just only 12 weeks per annum, but they amended the law in April 2020.

Full or part-time workers with fixed days or fixed hours

In complicated cases, when a worker is working in shifts, casual, term-time, and zero-hours contracts, the HR personnel of the organisation will calculate the holiday pay by taking the average number of working hours from the past 52 weeks.

Also, it means it does not involve the counting of non-working weeks. In simple words, if the working hours of a person change, holiday pay will be done after your usual pay rate.

How to calculate average pay?

In the UK, workers have the right to receive holiday pay, similar to other European countries. The calculation of this holiday pay is based on a method known as the averaging method. In simple words, this method is like looking back at the previous 52 weeks from which they have paid an employee. So, this method depends upon the pay.

For better understanding, we have gathered some points below:

- For this method, you have to look back at the previous 52 weeks and deduct the weeks in which the person has earned no amount. However, in other cases, any employee employed for less than 52 weeks then looks at only those full weeks in which he has worked or paid.

- The employer must pay for only those weeks in which the employee has received a salary for their work as holiday payment.

- In case the salary amount reduces due to statutory sick pay during the calculation, the employer will need to use another week in which the worker received a normal salary for the calculation.

- For calculating the average method, you do not need to look back at the previous 104 weeks. Instead, focus on 52 weeks to consider discounted weeks for the worker.

- You should calculate the employee’s average weekly earnings during regularly paid overtime, commission, and bonuses.

- At the end, remember the holiday pay for a week of an employee is based on the average weekly working hours multiplied by the current hourly rate (agreed) of that particular employee.

Rolled-up holiday pay

As of now, you are completely aware of the holiday pay. You should also know that an employee must get the payment for your holiday.

However, sometimes the employer extends the employee holiday pay over the year by adding an amount on top of your hourly recruitment rate. The process or procedure referred to as ‘rolled-up’ holiday pay. Some employers do this to their workers, which is not a good procedure.

How does holiday pay work when an employee leaves?

It is normal for workers to change their jobs from one organisation to another in search of salaries and other benefits.

So when an individual leaves an organisation, the employers must pay him/her annual leaves, which are not taken until the last day of the employment. This leave is known as ‘pay in lieu of holiday’. They give this to the employee upon termination, discharge, and dismissal of an employee.

Therefore, the number of years an employee has worked, the amount and type of leave taken, and the employee’s preference to carry over unused leave from the previous year, will determine their entitlement to annual paid leave.

It is important to note that eligibility for unused accrued contractual leave is subject to the terms and conditions of the employment agreement.

How do Overtime, commission, and bonus affect your Holiday pay?

The company gives overtime, commission, or bonuses on a compensation or welfare basis.

However, in the case of paid annual leave, the employer must include these benefits in a minimum of 4 weeks of holiday pay for the employee.

We have seen that some employers add these benefits (overtime, commission, and bonus) in the employee’s full 5.6 weeks’ paid holiday; however, they do not have to add them. The reason for not having them on annual leave is the law. The law on overtime, commission, and bonus payments included in holiday pay is based on the EU Working Time Directive.

How should holiday pay Issues be handled?

Paid annual leave or holiday pay is a basic legal right that for an employee an employer must provide to its workers for its brand-making and not to create any dispute. However, if the terms and payment of annual leave are unsatisfactory to an employee, they may bring a claim to the employment tribunal (if the matter has not been resolved internally).

As we all know, legal actions are time-consuming and costly; therefore, try to resolve the dispute yourself.

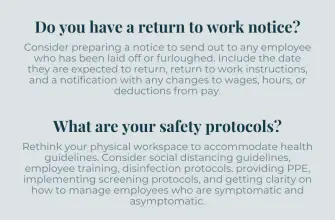

After looking at this, follow the below tips for handling the pay issues. These tips will help the employers to minimise the risk of a dispute before going to a tribunal hearing. Also, it will help them maintain a positive working environment and a bigger brand than their competitors.

Tips for handling the pay issues.

- Circulate your holiday pay policy clearly among your employees. Once you hire a new employee, you should ensure they know your policy regarding annual leave entitlement and all your concerns. To avoid any disputes or confusion among each other.

- Inform workers of their annual leave year in writing. It typically runs from 1 January to 31 December, but for employees joining during this period, their first day counts as the start of their leave year.

- Accessibility of your holiday pay policy: for easy access, the employer must put this policy in an employee handbook, or you can also save a soft copy on their PCs.

- Provide a procedure for holiday pay disputes with your employees: you should have a clear written procedure for dealing with issues regarding the disputes of holiday pay and workplace issues; this practice will help you resolve your disputes with the workers so that they can understand their employers correctly paid them and they will not go to an employment tribunal or take some other legal actions.

- Add a clear holiday pay calculation in a payslip: you are calculating annual holiday payment at your hand, but this is not in your employee’s mind. Therefore, it is best practice to include a rational option for calculating or utilizing any pay in place of the holiday.

Frequently Asked Questions (FAQs)

As of now, you are completely aware of the holiday pay. You should also know that an employee must get the payment for your holiday. However, in some cases, the employer extends the employee holiday pay over the year just by adding an amount on top of your hourly recruitment rate. This process or procedure is known as ‘rolled-up’ holiday pay.

If an employee did not work the fixed or regular hours and did not receive the same pay for each week and month, the employer can calculate the holiday pay by looking at the employee’s working hours for the previous 52 weeks. This is called the holiday pay reference period.

As explained in our above post, most UK employees have the right to 5.6 weeks of paid holiday per annum. This is the minimum amount of paid leave an eligible employee is entitled to take from their employer.

Yes, you may avail this opportunity as this is in the law of the UK for this entitlement. The employer must respect your right and provide paid annual leave. However, an employee can go to an employment tribunal in case of any dispute and if it can not be solved internally.