When it comes to managing staff redundancies or terminations, employers often find themselves navigating a complex web of legal and financial considerations. Two key elements in this process are redundancy and settlement agreements. Both offer different advantages and potential pitfalls, and understanding the nuances of each can help employers make informed decisions that protect both their interests and those of their employees. This guide will delve into the intricacies of redundancy vs settlement agreements, providing employers with the knowledge they need to handle these situations effectively and fairly.

Understanding Redundancy and Settlement Agreements

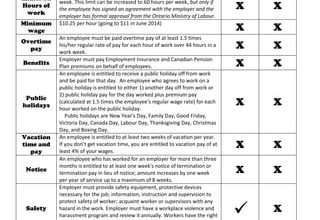

Before we delve into the specifics, it’s important to understand what redundancy and settlement agreements are. Redundancy is a form of dismissal from your job, happening when employers need to reduce their workforce. If you’re being made redundant, you might be eligible for certain rights, including redundancy pay, a notice period, a consultation with your employer, the option to move into different jobs, and time off to find a new job.

On the other hand, a settlement agreement is a legally binding contract between employer and employee which sets out the terms and conditions under which the employment relationship will end, or a dispute will be settled. It usually provides for a severance payment by the employer, in return for which the employee agrees not to pursue any claim they may have at an employment tribunal.

Redundancy Settlement Agreement

A redundancy settlement agreement is a specific type of settlement agreement used when an employer is considering making one or more employees redundant. The agreement outlines the terms of the redundancy, including any enhanced redundancy pay, and ensures that the employee cannot bring a claim for unfair dismissal against the employer.

- Enhanced Redundancy Pay: This is an additional amount of money that some employers choose to give to their employees when they are made redundant. It is above and beyond the statutory redundancy pay that is required by law. The terms of enhanced redundancy pay should be clearly outlined in the redundancy settlement agreement.

- Settlement Agreement Calculator Acas: The Advisory, Conciliation and Arbitration Service (ACAS) provides a settlement agreement calculator to help employers and employees understand the potential costs of a settlement agreement. This can be a useful tool when negotiating the terms of a redundancy settlement agreement.

Resignation Settlement Agreement

A resignation settlement agreement is another type of settlement agreement that is used when an employee chooses to resign from their position. This type of agreement can be used to resolve any disputes that may have arisen during the employment relationship and to ensure that the employee cannot bring a claim against the employer after they have left the company.

Statutory Offer of Settlement

A statutory offer of settlement is an offer made by an employer to an employee to settle a potential employment tribunal claim. The offer is made under the rules of the employment tribunal, and if it is not accepted within a certain time frame, it can be used as evidence in any subsequent tribunal proceedings.

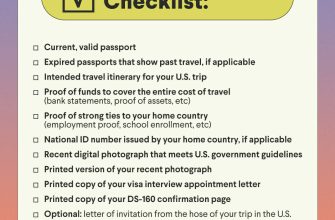

How Long Do I Have to Sign a Settlement Agreement?

Under UK law, employees must be given a reasonable amount of time to consider a settlement agreement before they are asked to sign it. ACAS guidelines suggest that a minimum period of 10 calendar days should be allowed, unless the parties agree otherwise.

Avoiding Tax on Redundancy Payments

Redundancy payments, up to a certain limit, are not subject to tax. The tax-free limit is currently £30,000. Any amount above this is taxable. However, there are ways to structure a redundancy payment to minimise the tax liability, such as making a payment into a pension scheme.

Typical Severance Package in the UK

The typical severance package in the UK will often include the following:

- Statutory redundancy pay

- A payment in lieu of notice

- Any outstanding holiday pay

- Any additional compensation or benefits as outlined in the employee’s contract

Redundancy Payout

A redundancy payout is the amount of money that an employee receives when they are made redundant. This will usually include statutory redundancy pay, any payment in lieu of notice, and any outstanding holiday pay. The amount of statutory redundancy pay an employee is entitled to depends on their age, how long they have been employed, and their weekly pay.

Conclusion

Understanding the differences between redundancy and settlement agreements, and knowing when to use each, is crucial for employers. Both offer different advantages and potential pitfalls, and the choice between the two will depend on the specific circumstances of each case. By being informed and taking the time to consider all options, employers can ensure that they handle these situations in a way that is fair, legal, and beneficial for all parties involved.