As an employer in the UK, it’s crucial to understand the legalities and potential risks associated with withholding employee pay. This guide will provide you with a comprehensive overview of the laws and regulations surrounding this issue, including the circumstances under which you can legally withhold pay, the potential consequences of illegal withholding, and the rights of employees in these situations. It’s important to note that while this guide is intended to be informative, it should not replace legal advice from a qualified professional.

Understanding the Legality of Withholding Pay

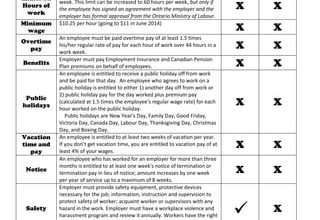

Generally, it is illegal for an employer to withhold pay from an employee without a valid reason. The Employment Rights Act 1996 states that an employer cannot make deductions from an employee’s wages unless the deduction is required or authorised by legislation, or the employee has agreed to it in writing. This means that an employer cannot withhold pay as a form of punishment or because of a dispute with the employee.

However, there are certain circumstances under which an employer can legally withhold pay. These include:

- Overpayment of wages in previous pay periods

- Recovery of a loan or advance given to the employee

- Deductions for income tax and National Insurance contributions

- Attachment orders a guide for employers, which are court orders requiring an employer to make deductions from an employee’s wages to pay off their debts

Risks of Withholding Pay

Withholding pay without a valid reason can lead to serious consequences for employers. If an employee believes their employer is unlawfully withholding their wages, they can take the matter to an employment tribunal. If the tribunal finds in favour of the employee, the employer may be ordered to pay the withheld wages, along with additional compensation.

Furthermore, withholding wages can damage an employer’s reputation and lead to a loss of trust among employees. This can result in decreased productivity, increased turnover, and difficulty attracting new talent.

Employee Rights and Employer Obligations

Employees have the right to receive a payslip detailing their pay and any deductions made. It is illegal not to provide a payslip, and employers who fail to do so can face penalties. If an employer hasn’t paid an employee, the employee has the right to take the matter to an employment tribunal or to make a claim to an employment tribunal for unlawful deduction of wages.

Employers are also obligated to pay employees on time. If an employer pays an employee late without a valid reason, the employee may be able to claim for unlawful deduction of wages.

Withholding Pay for Disciplinary Action

It is generally not legal for an employer to withhold pay as a form of disciplinary action. However, there are exceptions to this rule. For example, if an employee has been suspended on disciplinary grounds, the employer may be able to withhold pay for the period of the suspension, provided this is stipulated in the employee’s contract.

Withholding Final Pay

When an employee leaves a job, their employer is obligated to pay them for any work they have done. This includes any outstanding regular pay, as well as any holiday pay, commission, or bonuses that are due. If an employer withholds final pay without a valid reason, the employee can take the matter to an employment tribunal.

Conclusion

While there are certain circumstances under which an employer can legally withhold pay, doing so without a valid reason can lead to serious consequences. It’s important for employers to understand their obligations and the rights of their employees when it comes to pay. If you’re unsure about the legality of withholding pay in a particular situation, it’s always best to seek legal advice.